By Professor John Clancy and Professor David Bailey

Our last blog outlined the pension fund position at the Birmingham Children's Trust. It's fairly certain that in five weeks time the current surplus in the pension fund of £20million will rise to a stonking great £71million.

This, even though the West Midlands Pension Fund of which the Birmingham Children's Trust is a 1.3% member, knew full well when they set the employer contribution rate in early 2023 that the previous deficit had reduced by 95%. Bizarrely they actually increased the employer contributions for the Trust to 23% of employee payroll.

This £71million surplus is in the ownership of the Children's Trust, not Birmingham City Council. Surpluses in defined benefit pension funds are always in the ownership of the employer. That is simply the settled legal position. Because it represents overpayments by the employer to the fund by definition.

It also represents by definition miscalculations by the pension fund managers and actuaries.

Action is now required by the trust effectively to bring this surplus back into revenue.

This is because the overpayments since 2018 have been prepayments for futuure employer contributions. The trust has already paid the pension dues and so the credit for these means a reduction to 0%. This happened this year in Kensington and Chelsea by the way, the council as employer there is playing 0% for this coming year.

The Birmingham Children's Trust was set up , ironically by writer John Clancy, to be independent of the City Council. It is operationally independent, in particular. It was precisely to avoid the trust being dragged into the political context, and to restart the service away from the severe bureaucratic and other stark deficiencies then, as now, of Birmingham City Council.

So ring-fencing the Trust from the present Gove-Manufactured crisis position of the council is one of the defining operational independence tests for its board.

The Chief Executive of the Children's Trust should immediately apply without reference to Birmingham City Council at all for a re-certification of the Trust's employer contributions for 2025-26, with an expectation it should be 0% this coming year.

And we can't see any reason why that shouldn't be 0% for the following three years.

This is a Charitable Interest Company. The clue's in the title.

It's a trust. The clue's in the title

The board of the trust has to ask where their fiduciary duties lie. It has to be to the trust itself, and to the children of Birmingham: and specifically not to Birmingham City Council, its leader or its Chief Commissioner Max Caller Limited; not even to the Secretary of State, the Deputy Prime Minister.

Chief Executive James Thomas and his predecessor as chief executive, now Chair, Andy Couldrick must act to protect the Trust. If necessary, they should take independent legal and actuarial consultancy advice immediately too.

Whilst Max Caller Limited can influence the trust by determining how much the contract price should be, (it's a £1million cut this coming year) he would be acting ultra vires to interfere in the running of the trust and attempting to stop the re-certification.

If the Chief executive, Chair and board do not act they will be complicit in the continuing scandal, and be in breach of their fiduciary duties.

As an independent employer in the scheme, they could, of course, ask for another administering authority than Wolverhampton/ West Midlands Pension Fund to take over the Trust's pension fund. The Trust can apply to the Secretary of State for an order for such transfer under s.3 of the Public Service Pensions Act 2013. It has been used for such before. We would suggest the West Yorkshire local government pension fund.

Handily, this would also crystallise the assets and liabilities figure of the trust so we don't have to rely on the West Midlands Pension Fund basically making it up as they go along.

The board also has to question, bearing in mind it has an effective surplus coming into revenue whether it has been inappropriately strong-armed by Birmingham City Council to "join in" with the £150 million of cuts. Why should it? If Birmingham City Council and Max Caller Limited are so stupid as to not to sort out their own pension fund contributions, as an independent entity the trust should not be taking directions from them.

Does the trust really need to cut £23 million from its spend this year, in one year, under orders from the council? If this Trust is to display the kind of independence as required under its Trust Deed, it should not kow-tow to Birmingham City Council; indeed it would be possible further breach of its fiduciary duties to do so.

Just because Max Caller Limited is both incompetent and wilfully ignorant about the pensions position so he can look hard, is no reason for the Trust to press ahead with the cuts to children's services as part of a misguided sense of Osborne-esque "We're all in this together". And this is, indeed, part of a Tory Austerity 2.0 for Birmingham.

In any event the pension fund should now be invested in low risk assets going forward, so that the current assets are no longer in danger of huge falls in the future - and so locking in the high present value now for good .

With regard to the liabilities, it is perfectly possible for corporate bond rates to return to the 6% long term average which is likely to keep those liabilities where they are too. But they should also join the lobby for the Secretary of State to fix a floor in the discount rates for local government pension funds at 7% anyway, so we don't have this annual nonsense, on the pretence that these pension funds have ever been in any kind of danger whatsoever.

And let's not hear the equally nonsensical talk that these fund deficits can return and assets and liabilities can go up and down with the markets. That is Tory maths. These funds should never have been fed to the markets in the first place. They are taxpayer-funded sovereign wealth funds.

A Labour secretary of state can sort this situation with a stroke of the pen for good, too.

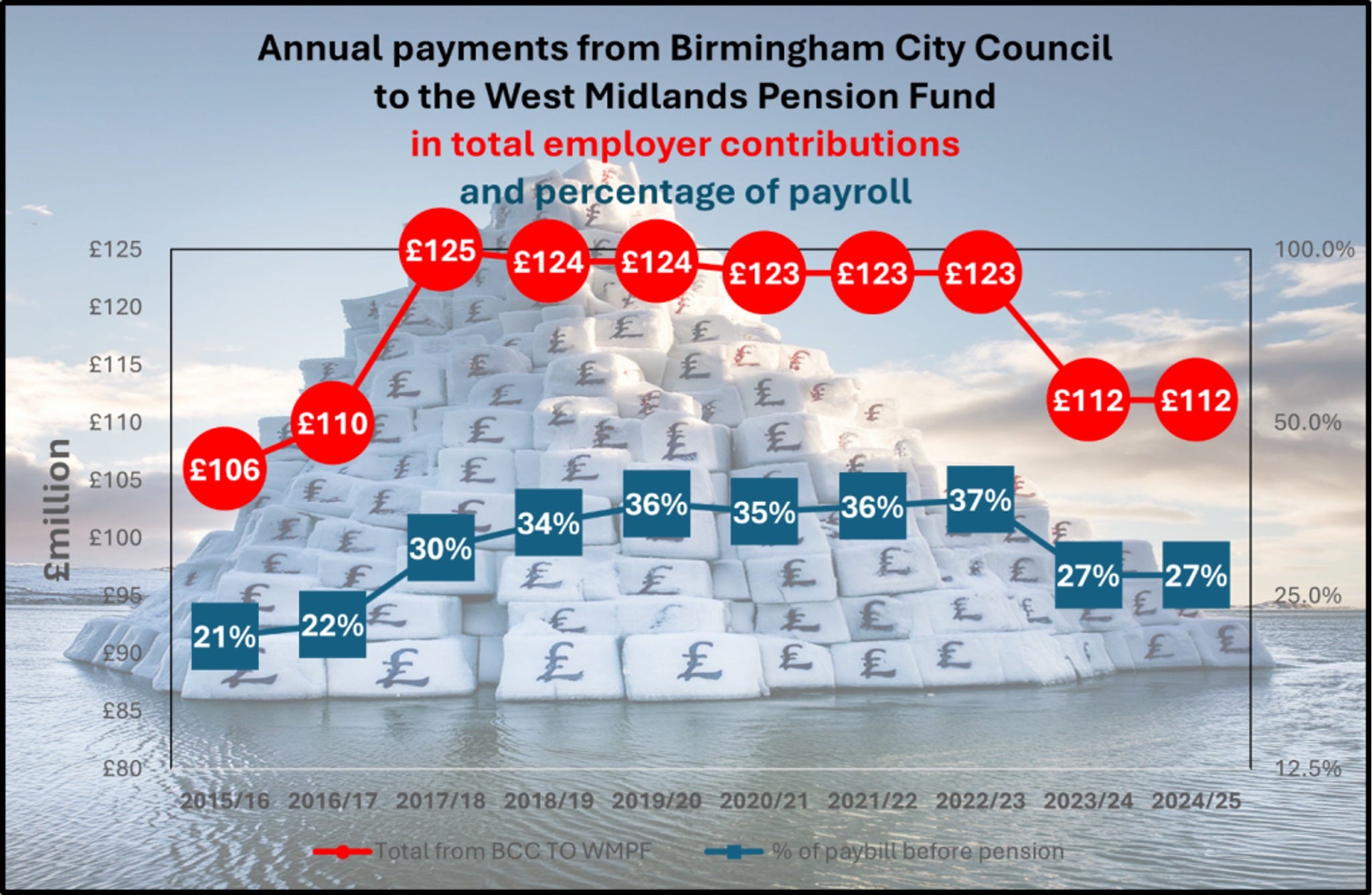

The irony of our research into the wider City Council pension fund position is that the liabilities have likely returned to exactly where they were ten years ago. All of the guff and nonsense of crisis-deficits and increases in contributions were literally a waste of time and money (though not for the investment managers who fed on them in expenses).

The same applies to the Trust.

So in reality, the Children's Trust did not have a pensions deficit when it was set up; and it does not have one now, quite the opposite - a highly likely surplus of £71million, created artificially and completely unnecessarily.

The chief executive, chair and board of the Trust must act now.

The Labour group of councillors on Birmingham city council seem to feel they have no choice but to march fully in step to the tune of Michael Gove and his lieutenant Max Caller Limited.

Perhaps the Chair of the Education, Children and Young People Overview and Scrutiny Committee can break step to review the Children's Trust pension fund position, and ask the chair and chief executive whether they are prepared to break step as well.

As for the rest of the Labour group.

It's time for you to stand up for the city's children.

picture credit: Birmingham: Victoria Square author John Sutton https://creativecommons.org/licenses/by-sa/2.0/deed.en, Used as background for chart

.jpg)

John Clancy and David Bailey

John Clancy and David Bailey