We understand from the ITV central news report about our December 3rd blog that Birmingham City Council officers "are taking some time to look through and digest the academic report".

One of the things we are sure they are struggling with will be the advice they will undoubtedly have received that a surplus in the council pension fund is some kind of notional unusable reserve which the council can't go anywhere near.

Apart from the fact that a direction to the contrary could be sought from the Secretary of State in relation to those reserves, it's not needed anyway.

Wolverhampton City Council simply have to arrange for the sum to be turned into revenue.

(Nudge Chief Commissioner Caller - the stopwatch is still ticking!)

Reg.60(4) of the The Local Government Pension Scheme Regulations 2013

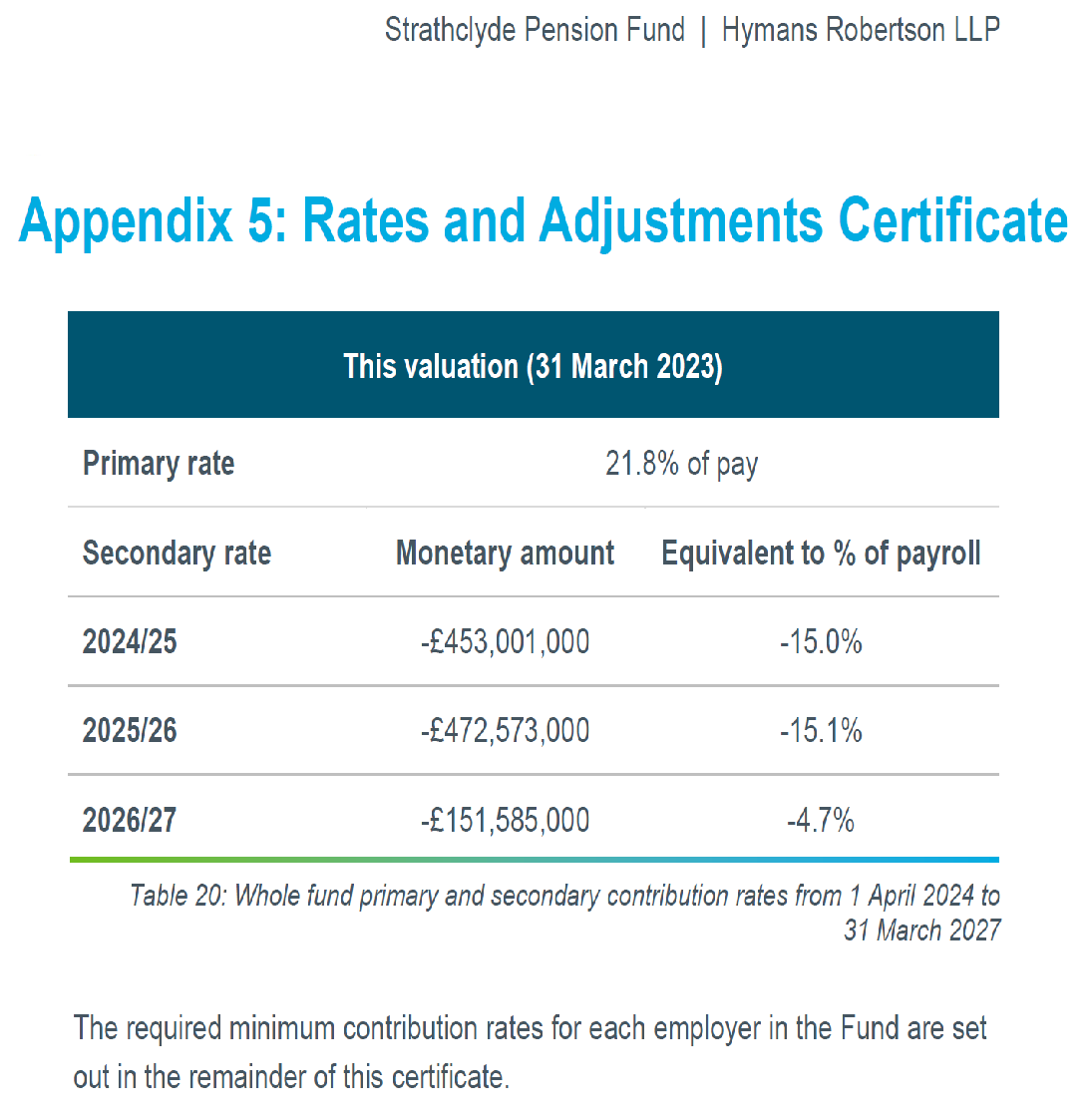

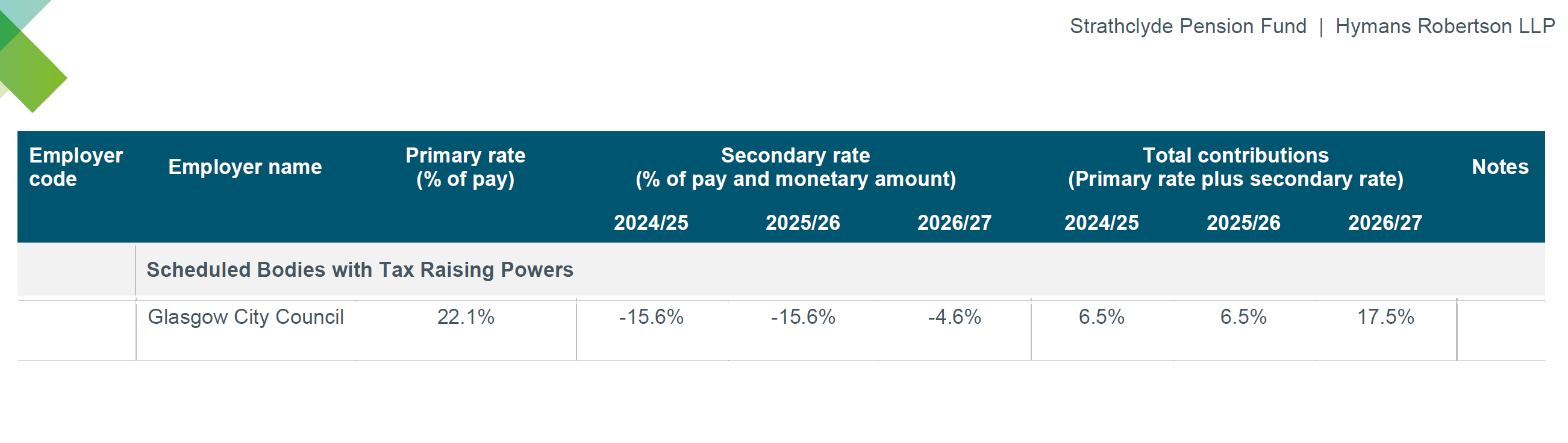

So you will see above what happened in Glasgow, one of our 10 UK core cities.

Glasgow City Council, who administers the Strathclyde pension fund of which it is a member, is handing back £1billion pounds of its surplus over the next three years.

It simply says, we won't require you to pay your full contributions, just pay us a bit.

Consequently Glasgow is paying just 6 ½ % of its employer's contributions for this and again next year!

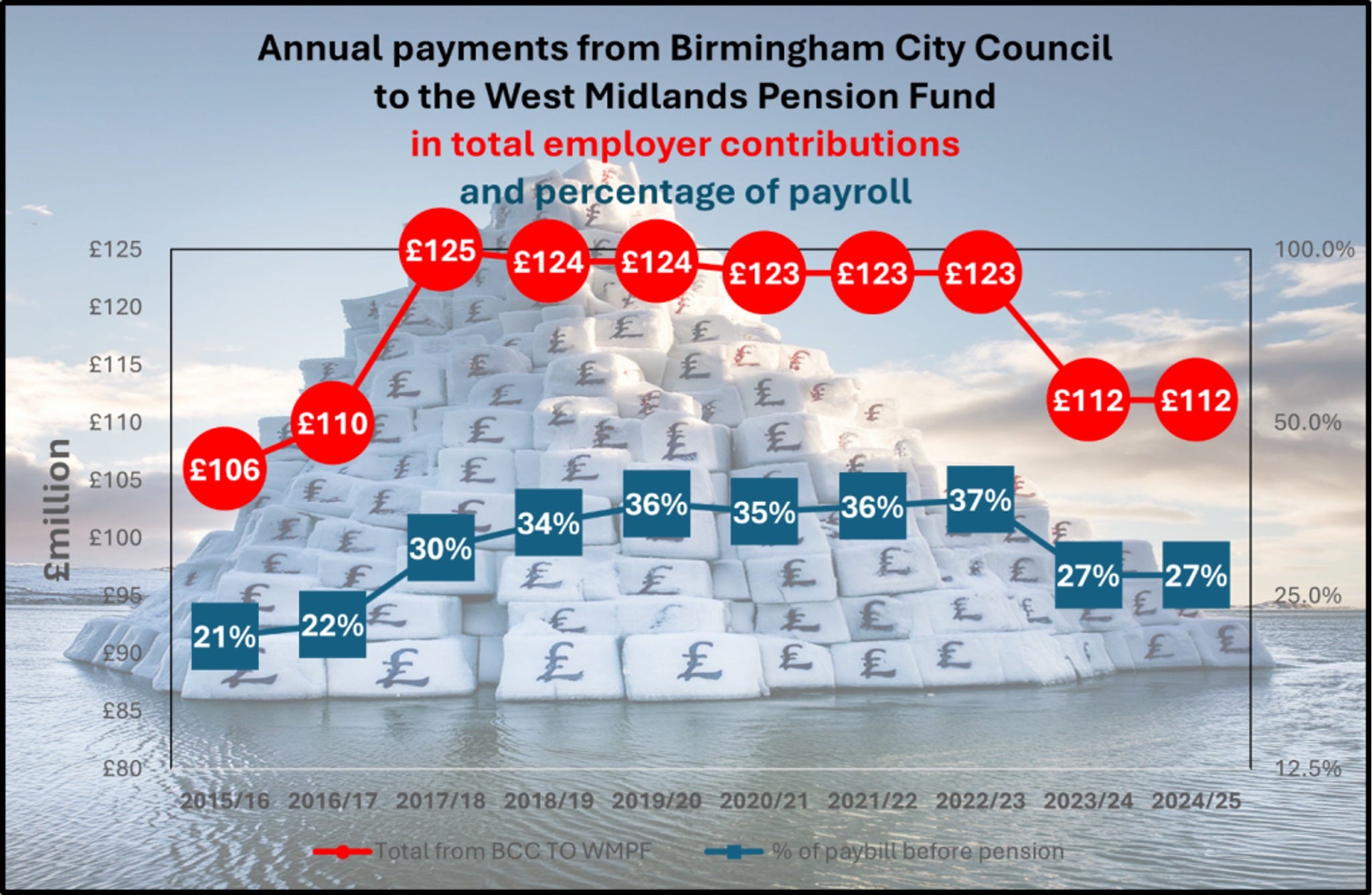

As a reminder, Birmingham has been paying 26% this year, and 26% again from April 2025. That's likely £225 million.

So it really is as simple as that, Birmingham City Council.

It really is as simple as that, Chief Commissioner Caller.

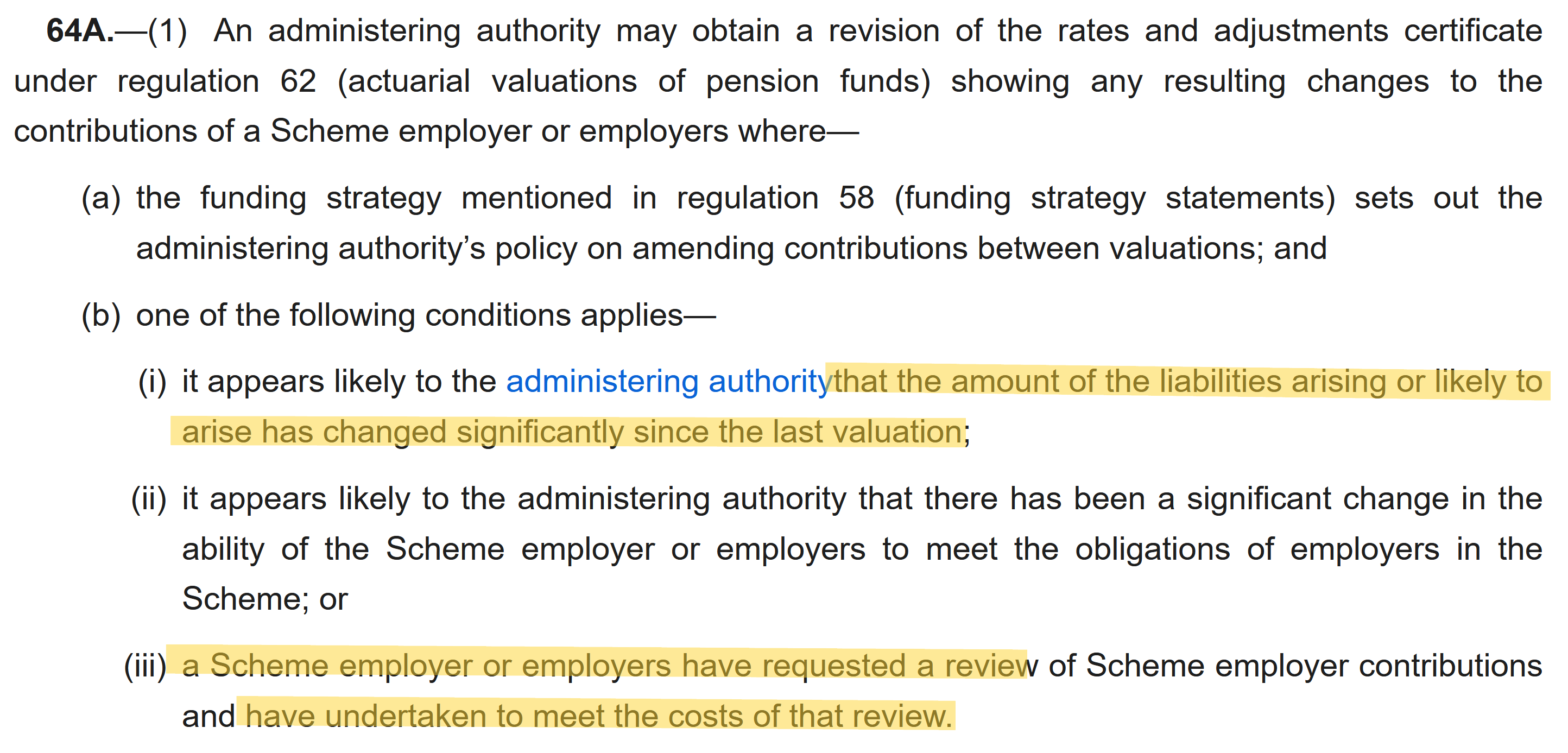

No doubt some further advice will have been received that the council has to wait for the results of the next valuation which will report in 2026.

Not so.

Reg.64A of The Local Government Pension Scheme Regulations 2013

It seems quite clear that circumstances exist to enable Reg.64A to be brought in operation. Birmingham city council needs to simply request a review and re-certification of the council's contributions. They might need to meet the costs, but it will be small-fry compared to the 100s of £millions to be gained.

Having said that, in these extraordinary circumstances either the WMPF decides of its own volition to meet those costs out of this year's equally extraordinary £127million management fees, or the Secretary of State directs them to meet the costs.

Clearly, if some other of the 700+ other employers wish to join in, we're sure that would save everyone a lot of time and effort.

As we said in our action plan, this isn't something to take time over. It needs to happen now, in order to prevent Birmingham City Council having to make hundreds of millions of pounds of cuts starting next April. We need a re-certification well before then. So it can't wait until after Christmas.

The Max Caller stopwatch is currently on 7 days - to tell us what was the surplus in the Birmingham City Council Pension Fund on 31st March last.

He knows it. We're sure the finance team at Birmingham City Council must know it, why can't the rest of us know it? While he's at it, he might want to give us an estimate at what it stands at now, and what it is likely to be by the end of the financial year. We think just Birmingham's surplus could be £1.1 billion.

Seven days is too long.

Stop dithering, Birmingham City Council.

Come clean Max Caller.

.jpg)

John Clancy and David Bailey

John Clancy and David Bailey