Blogs from the Blackstuff

Professor John Clancy and Professor David Bailey

Blogs from the Blackstuff

Blogs from the Blackstuff

Blogs from the Blackstuff

By Professor David Bailey and Professor John Clancy

3rd February 2026

Breaking News

Times are tough.

So Labour prioritises £16 billion for investment bankers.

Paid for from the budgets of every UK council, every UK state school, every UK FE college, and all UK police and fire services.

Priorities, eh?

Expenses to soar as UK LGPS Combined Assets set to pass $0.7Trillion, at £517 billion.

Times are tough.

So Labour prioritises £16 billion for investment bankers.

Paid for from the budgets of every UK council, every UK state school, every UK FE college, and all UK police and fire services.

Priorities, eh?

Expenses to soar as UK LGPS Combined Assets set to pass $0.7Trillion, at £517 billion.

Paid for from the budgets of every UK council, every UK state school, every UK FE college, and all UK police and fire services.

Priorities, eh?

Expenses to soar as UK LGPS Combined Assets set to pass $0.7Trillion, at £517 billion.

Its been a very good year.

Well it might not have been for you, but those bond and stock markets have had a whale of a time. About 17% up since last financial year-end on 31st March last.

We know this from the West Midlands Pension Fund and others who publish regular updates of the value of their asset bases.

If we apply the 17% across the 97 separate local funds in the UK local Government Pension Scheme, which last March 31st were £470Billion, we can exclusively reveal the value of the scheme’s assets likely now sits at well over half a £Trillion, on

at least £517 billion.

Combined, they take an average of 59 basis points each year, whether the fund soars or plummets.

And they’ve had a very good year.

They have finally passed the big milestone!

£3 billion

in management expenses.

How long ago it now seems that they were slicing off only the £2 billion....er....well, in March 2024.

Not bad...finding another 50% in just 2 years! That's another £1B, you know!

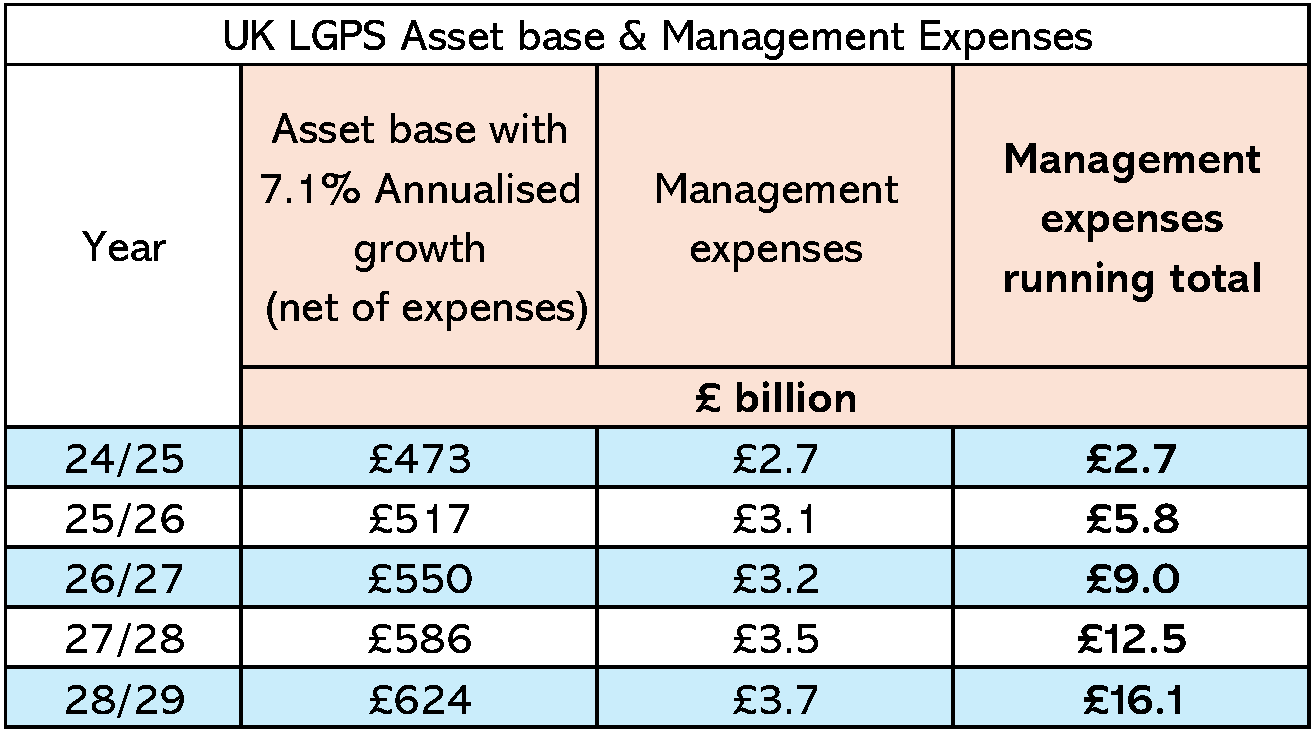

As we also know, come rain or shine, investment returns at the LGPS eventually always level out at an annualised 7.1% over the short, medium and long term: well they have done for the last, 5, 10, 20 and 30 Years, anyway.

So if we assume those gross returns 'til 2029, there's going to be some nice new paydays coming up.

Whilst they can't quite prepare to pass the £4 billion mark by the end of the parliament, the UK LGPS's investment bankers and other managers can at least brag to their Mates in the States that they will pass the $5 billion-a-year fees mark.

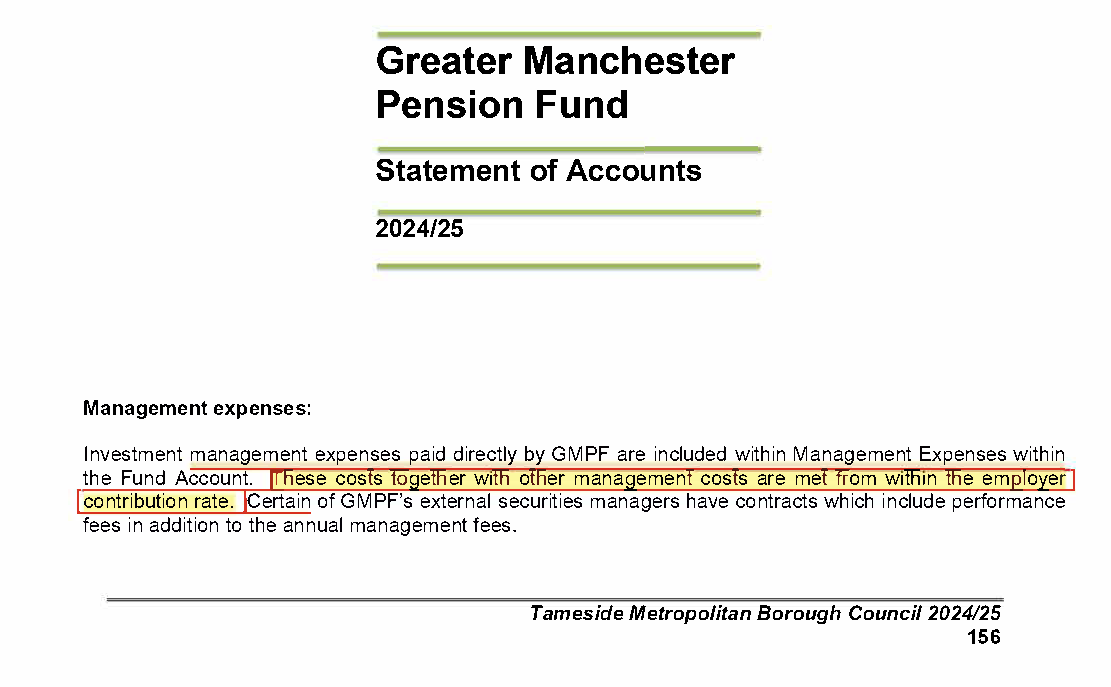

We have repeatedly made the point here that because pension funds start their contribution calculations with a gross future investment return calculation ('the 'discount rate') that management expenses are automatically met from already artificially high employer contributions.

Hiding in plain sight on page 59 in last year's Annual Report of the Greater Manchester Pension Fund (the UK's biggest) a particular helpful explanation slipped through the net:

You don't often see this so explicitly stated.

So, to be crystal clear: the management expenses of each pension fund are met from within the employer contributions - on every LGPS employee's pay slip.

In every council, in every state school, in every FE college, in every police and fire authority and in most universities, that $5 billion will be paid for more than once by you and us as council tax payers, income tax payers, asset tax payers, fuel taxpayers, VAT payers.

So the $5 billion by 2029 is actually going to be paid, as this year's $4 billion was, directly by you and me.

It's not the pension fund that's being top-sliced, it's the UK taxpayer.

But times are tough. And that requires some tough decisions to be made about what the government spends taxpayers' money on. And what it does not. It's about priorities.

So while its apparently soaring costs requires this government to implement and prepare the ground for a squeeze on SEND, SENDing bankers £16 billion over the parliament is soaring-worth-it, according to the priorities of this (present) government.

John Clancy and David Bailey

John Clancy and David Bailey