Blogs from the Blackstuff

Professor John Clancy and Professor David Bailey

Blogs from the Blackstuff

Blogs from the Blackstuff

Blogs from the Blackstuff

By Professor John Clancy and Professor David Bailey

31st December 2025

Carry on Birmingham!

Its £14 million deficit reduction repayments...for a deficit which doesn't exist!

And it's still paying, even though The Chief Commissioner knows it doesn't exist.

When you've filled in a hole - stop digging!

Carry on Birmingham!

Its £14 million deficit reduction repayments...for a deficit which doesn't exist!

And it's still paying, even though The Chief Commissioner knows it doesn't exist.

When you've filled in a hole - stop digging!

In our last blog we explained how there is a Birmingham City Council pension fund surplus of at least £1.9 billion, due to fundamental miscalculations at the West Midlands Pension Fund over the last ten years.

The law and the pension fund’s own rules require this surplus to be returned to the employer. This is because the employee contributions are fixed, but the employer’s contributions float and are determined by calculations at the pension fund.

In this case they were miscalculations.

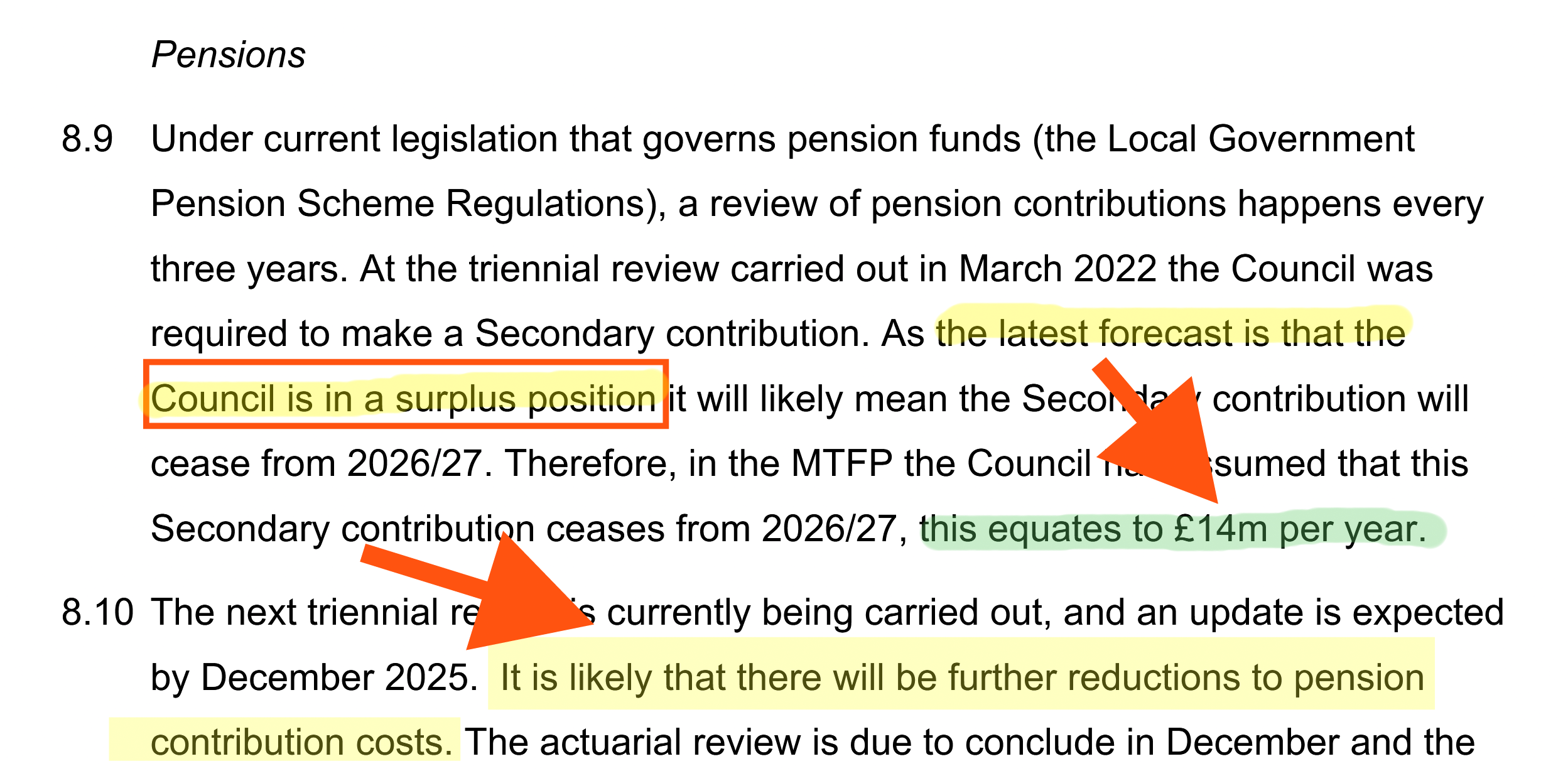

Birmingham City Council itself has finally been forced to acknowledge that its pension fund has unquestionably moved into surplus.

Since admitting this, however, it has continued, bizarrely, to pay a deficit reduction payment of 5.2% on every employee’s pay slip when there was no such deficit.

The Council again has admitted that this amounts to £14 million a year, which could otherwise have been spent on services, or reducing council tax for that matter.

So that's £14 million to pay down a deficit which they admit doesn’t exist. And for a pension fund which they admit is, in fact, in surplus.

They finally admitted to this in October 2025 in a Cabinet report. They said they were paying £14 million a year in deficit reduction contributions to reduce an imaginary deficit.

At the time this report was published there were seven months left of this financial year (a year when huge cuts took place in the budget).

So, you do the maths.

Even though there was no deficit, in fact a stonking great surplus of £1.3 billion, the council committed to continuing to pay £8.2M (7/12th of £14 million), for the remainder of the year.

When it did not need to.

The just-paid December pay bill, plus January’s, February’s, and March’s means that even now, £5Million is being drained from the City Council’s finances to pay off an imaginary deficit.

This really is Alice in Wonderland stuff.

The same cabinet report has allowed for £20 million a year over the next few years to deal with the Oracle computer disaster.

So the failure to deal with these deficit payments is the equivalent of 70% of an Oracle computer disaster.

It hasn’t got quite the same amount of political and media coverage has it?

As we pointed out last time, not all of the deficit reduction payments will come from the core budget, but probably 80% does, and so it does have an impact on the cuts that were made this year.

When the Council realised that it did not in actual fact have a funding deficit, they should have asked for an immediate LGPS Regs 2013 Reg. 62A(b)(iii) recertification with a specific request that the deficit reduction payments should stop forthwith.

Of course, they shouldn’t have had to have done this. The West Midlands Pension Fund itself should have.

The pension fund managers more than anyone else would have been acutely aware the fund was in a huge funding surplus, probably as far back as 18 months ago. And they should have formally informed the seven councils, and the 700-odd other employers in the fund of this.

They should have told them that they should immediately stop paying their deficit reduction contributions because … er….you know….there was...er, in fact, no deficit!

In addition to the councils, they should have told the police, the fire service, every single state school in the West Midlands, all the FE Colleges and the universities in the fund.

Where there is a considerable change in liabilities for an employer the pension fund itself should intervene under Reg 62A to recertify everyone’s employer contributions immediately.

They didn’t.

The sudden disappearance of a deficit was such a considerable change in liabilities. And even more so the appearance of a stonking great surplus at the fund of likely £8.3 billion.

We would suggest the failure to act by the West Midlands Pension Fund had more to do with protecting themselves and their appalling miscalculations, and hoping that no one would notice for a couple of years. It would all eventually come out in the wash and could be sorted out later; you know... in the fullness of time.

So just keep paying, and cutting your services , instead.

We pointed out repeatedly over the last 12 months that the accounting liabilities which were being reported from the pension fund’s own accounts, and in the other West Midlands Councils’ accounts, were a clear indicator that the funding liabilities had collapsed as well.

We pointed out that the fund had clearly moved into a a clear and obvious funding surplus. And probably some time ago. We would assert as early as spring 2024.

On 30th June 2024 respected actuaries firm isio published their LGPS (England and Wales) Low-Risk Funding Index results and analysis of the position across the 87 England and Wales funds. Even on a cautious low-risk analysis, more than 80% of these funds were well into big surpluses, including the West Midlands. And their advice was clear: cut contributions now, and not to wait until what would end up being 2026, or even further over-funding would occur.Which is why we sounded alarm bells in December 2024, because the 100s of £millions - worth of cuts that were being prepared at Birmingham City Council.

Over the summer of 2025, Birmingham City Council clearly worked out that we were right.

In the early autumn of 2025, Birmingham City Council actually had to admit it.

Isio turned out to be correct too. Massive over-funding has occurred by simply waiting (and probably fund managers hoping that it would all go away in the meantime).

So the question is when actually did the present Chief Commissioner know there was at least no deficit?

And,further, when did he know the likely size of the surplus? And if he didn’t know, why didn’t he know, or at least try to find out?

And when did the previous financially illiterate Chief Commissioner know?

And did either of them at any stage tell the pretend leader of the council John Cotton?

John Clancy and David Bailey

John Clancy and David Bailey