Blogs from the Blackstuff

Professor John Clancy and Professor David Bailey

Blogs from the Blackstuff

Blogs from the Blackstuff

Blogs from the Blackstuff

By Professor John Clancy and Professor David Bailey

9th November 2025

Local Government Pension Fund employer contributions to fall by £10 billion a year - for the next three years

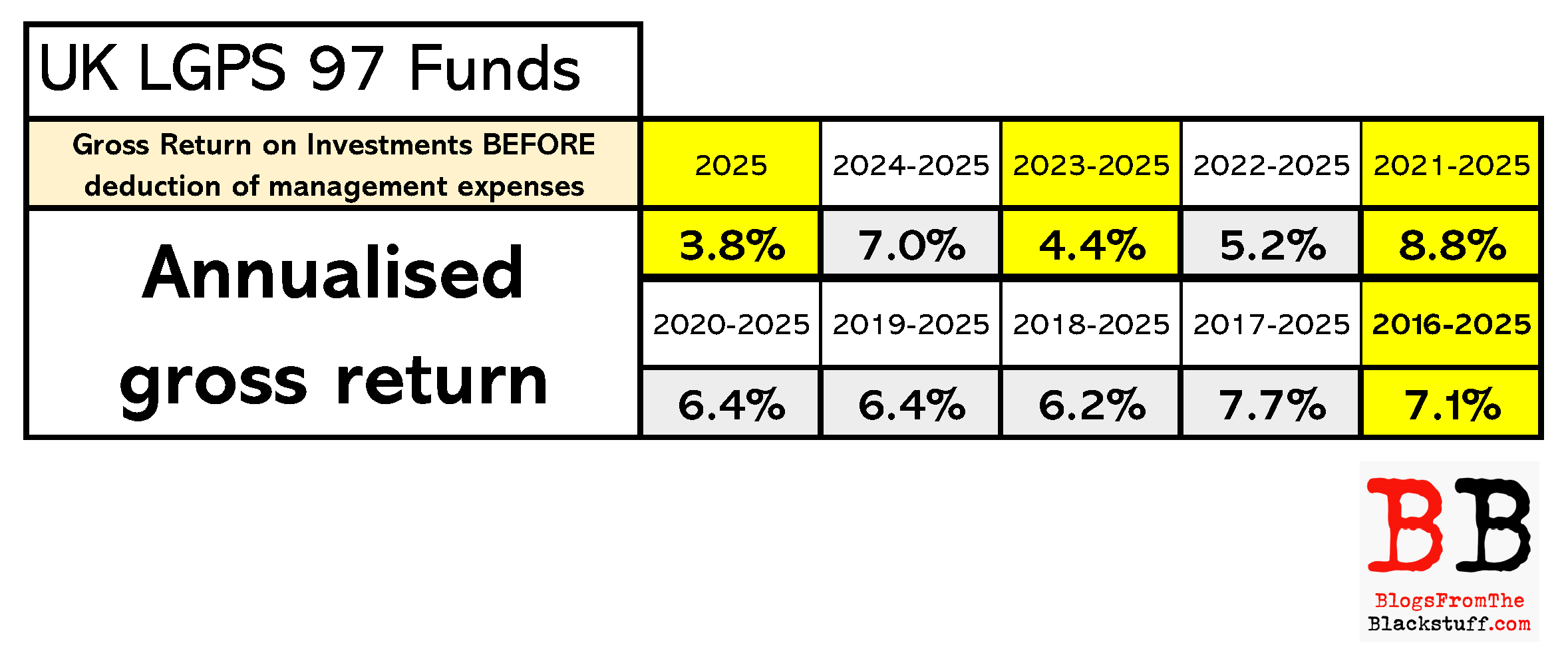

as 10 year annualised returns settle at 7.1%.

Sudden massive fiscal headroom available, if the Chancellor acts fast!

Local Government Pension Fund employer contributions to fall by £10 billion a year - for the next three years

as 10 year annualised returns settle at 7.1%.

Sudden massive fiscal headroom available, if the Chancellor acts fast!

Sudden massive fiscal headroom available, if the Chancellor acts fast!

We are now able to exclusively report that the annualised gross return on investment of the UK Local Government Pension Scheme over the last 10 years was 7.1%.

This means the Chancellor has fiscal headroom which we suspect the Treasury and the OBR will be unable to evidence they have identified yet.

The pension fund valuations still taking place at a snail's pace have to set a figure at what they think investment returns will be over the long term; and that, in turn, determines what the employer contributions will be for the next three years. They call it 'the discount rate' just to confuse everybody.

The 7.1 percent figure means, as we predicted, that the valuations currently taking place to set the employer contributions should lead to a fall across the UK's 97 Local Government Pension Funds of at least £10 billion in employer contributions alone in each of the next three years remaining in this Parliament, April 2026-March 2029.

This should be news to nobody as that’s exactly what the government’s own statutorily established LGPS Strategic Advisory Board declared to be the case earlier this year, and they went further: SAB Declared that 7% had been the returns on investment for LGPS funds over the very long term, beyond 10 years.

Councils and funds will no doubt point to a net return over the ten years of 6.5%. But the only reason for this has been the now-record management expenses of £2.7 billion a year, which cuts the net return to 6.5%. But only if they committed to continue paying those exorbitant fees into the future; and also taking the cumulative loss of investment by removing it.

The problem for the pension funds is that they got their prediction of investment returns incompetently wrong three years ago in 2022, Essentially assuming that the suppression of returns due to COVID would last forever.

So every one of the 97 pension funds has to start their calculation of employer contributions for the next three years assuming a 7% ongoing annual return on their investments. That will cascade into an enormous collapse in the amount Employers (and that means mainly councils) will have to pay for the next three years.

Employers currently pay £11 Billion in employers’ primary contributions and £0.9 billion in utterly bizarre 'deficit reduction' secondary contributions, when everybody knows there is a stonking great surplus.

If local government got rid of the scandalous (now-record high) £2.7 billion paid in management expenses for the scheme, £2.4 billion of which went to investment bankers for their expenses, that alone would reduce employers contributions by £2 billion, because it is paid for by a 3% addition of payroll paid to the fund .

When they last did this calculation, three years ago, they thought their ongoing investment return (pretty much forever) was going to be 4.4%. So, for the last three years employers were forced to pay a completely unnecessary average 20% of payroll into pensions.

The chickens have now come home to roost, but you can smell the fear in the 97 Pension Funds' hen houses - because they know the game’s up.

Most will have to settle at 6.5% or higher as their base calculation figure - higher where they are prepared to do something about the exorbitant management expenses.

Others will try to introduce phantom liabilities created by introducing what’s called the ‘Prudence’ Level. They used this back in 2022 already, and that didn’t work out too well did it? The GAD needs to ensure that massaging of figures does not take place. It has already censured local government pension funds who have gone too low on their assumptions on investment return.

We predict that the impact of 6.5% being set widely (which we also still assert is too low) would result in employers' contributions falling from an average of 20% to an average of 6%.

But some will be much lower, or even near to 0%, for the next three years for those wooden spoon LGPFs where they got their figures spectacularly wrong back in 2023.

Primary contributions were £11 billion last year, so bearing in mind a movement of just 0.25 % or 25 basis points (BPs) on the basic calculation can reduce the employer’s contribution 2 Percentage points or 200 BPs, the national fiscal position changes by almost £0.25B each quarter per cent you are out.

Hence our calculation that, dealing only with the collapse in employer contributions, (never mind further calculations of the refund from the expected huge surplus in the UK LGPS) the OBR and Treasury should be modelling a likely fall of £10 billion in employers' contributions and therefore from the public sector spend.

Whilst they may suggest that the valuations are still in progress, they should hand the Chancellor an estimate before the budget of what it would be for an average 7% Discount rate, and then related figures downwards by 0.1%, all the way down to 5.8 % (which was what all of 97 funds used back in March to calculate their accounting liabilities).

The finance directors of every council in the country should also request the same calculation for their own councils from Their own actuaries and/or the Administering authority of their pension fund.

If the Treasury or OBR haven’t done these sums yet they should get their finger out again, stop holding it up to the wind, and crank up the calculator instead.

*Gross returns shown in the above video*

John Clancy and David Bailey

John Clancy and David Bailey